US-China Trade War Will Never End

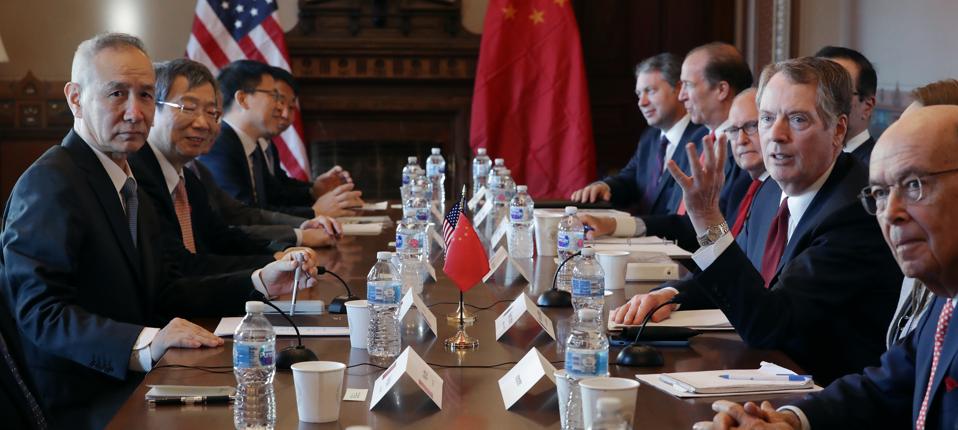

WASHINGTON, DC - JANUARY 30: U.S. Trade Representative Robert Lighthizer (2nd R), Commerce Secretary ... [+]

America and China will reach tentative trade deals that appease hard-liners on both ends. But they will never reach a real deal that changes the structure and the culture of the Chinese society—and therefore end the trade war.

American and Chinese trade negotiators seem to have reached a “principal consensus” in trade talks. That’s according to a Xinhua report published on Friday.

“In phone talks, the two sides had earnest and constructive discussions on properly addressing each other's core concerns, and reached principled consensus,” says the report.

That paves the way for some sort of agreement in the near future. “I think the Trump administration and China will strike a nominal trade deal of some kind within the next month - with agreements for agricultural goods and other trade issues that don't come with a lot of controversial baggage,” says Jeff Yastine, Senior Equities Analyst at Banyan Hill Publishing. “It'll be just enough for both sides to claim "victory" without necessarily having won any more substantive ground than when they started.”

Still, that will be sufficient to save face on both sides at this point.

“Chinese negotiators can take it back to Xi and he'll sign it to appease his own powerbase of party apparatchiks, Yastine adds. “And Trump can wave the agreement around at election rallies and say that he was able to bend the Chinese to his own will.

” But he thinks that this deal won’t address thorny issues.

“As far as substantial trade breakthroughs, on thorny issues like intellectual property and opening up the Chinese financial system to US banks - I don't think that will happen, in what's left of Trump's first term or in a second term if he wins one.,” says Yastine. “Without an election to win in 2024, I doubt that the president would even care to make it a priority of his administration.”

In fact, it may never happen, under any US President. Addressing China’s intellectual property issue requires both a change in the centuries old tradition that treats intellectual property as a “public good.” And opening up China’s financial system to US banks will undermine the vested interests of China’s ruling class. It uses banks to allocate credit according to political fiat rather than market forces.

Besides, opening up banks to competition could create a banking crisis similar to that which Japan experienced in the 1990s after it opened up its own banking system to US banks.

Then there are China’s grandiose claims in the South China Sea, which pit China against the US and its allies over freedom-of-navigation, and are commingled with trade.

Still, Yastine is hopeful that a real trade deal may be reached if markets force the two sides to hold serious talks. “The only x-factor that might change the current trade algebra is if there was some kind of global stock market crash or banking crisis. Much as we saw in 2008, events of that type tend to focus the attention of policymakers and make heretofore "impossible" deals possible,” he says.

“In such a situation, the threat of events spinning even further out of the control of both sides might be just enough to compel them to hold serious talks and eliminate this large amount of uncertainty hanging over the global economy.”